Money kit

Solve consumer money needs with modern money stack

Mobile Wallets Card Issuing P2P Payments

Card Programs

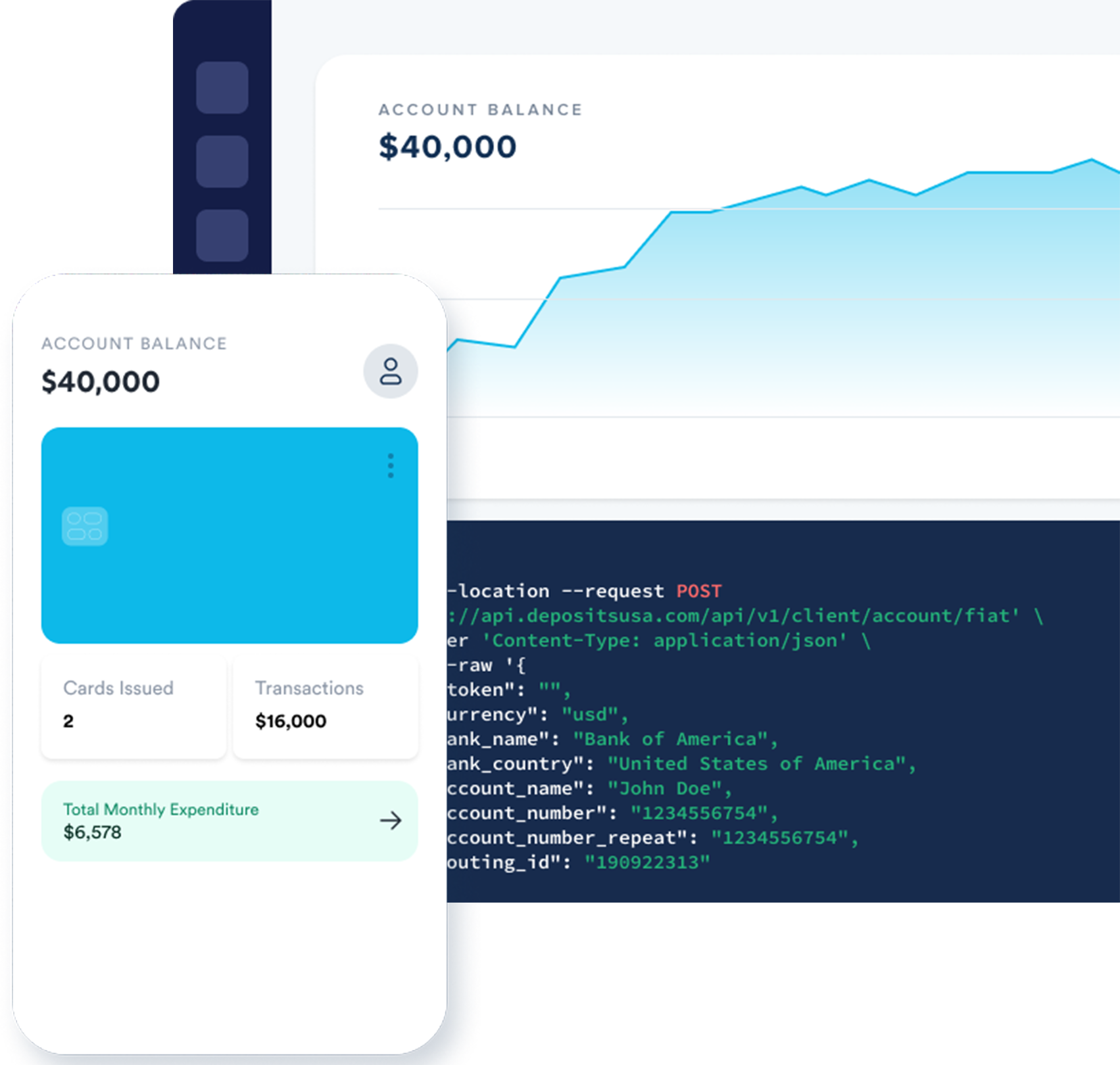

Easily create and manage virtual and physical cards. Everything you need to create a card program that suites your model

Advanced features

Full-featured digital wallet with support for P2P Transfers, Bill & Merchant Payments, Push to Debit, and Multi-currency wallet use cases.

Payment Acceptance

Build and scale a flexible card program that delivers reliable money experiences for your users - however they choose to pay

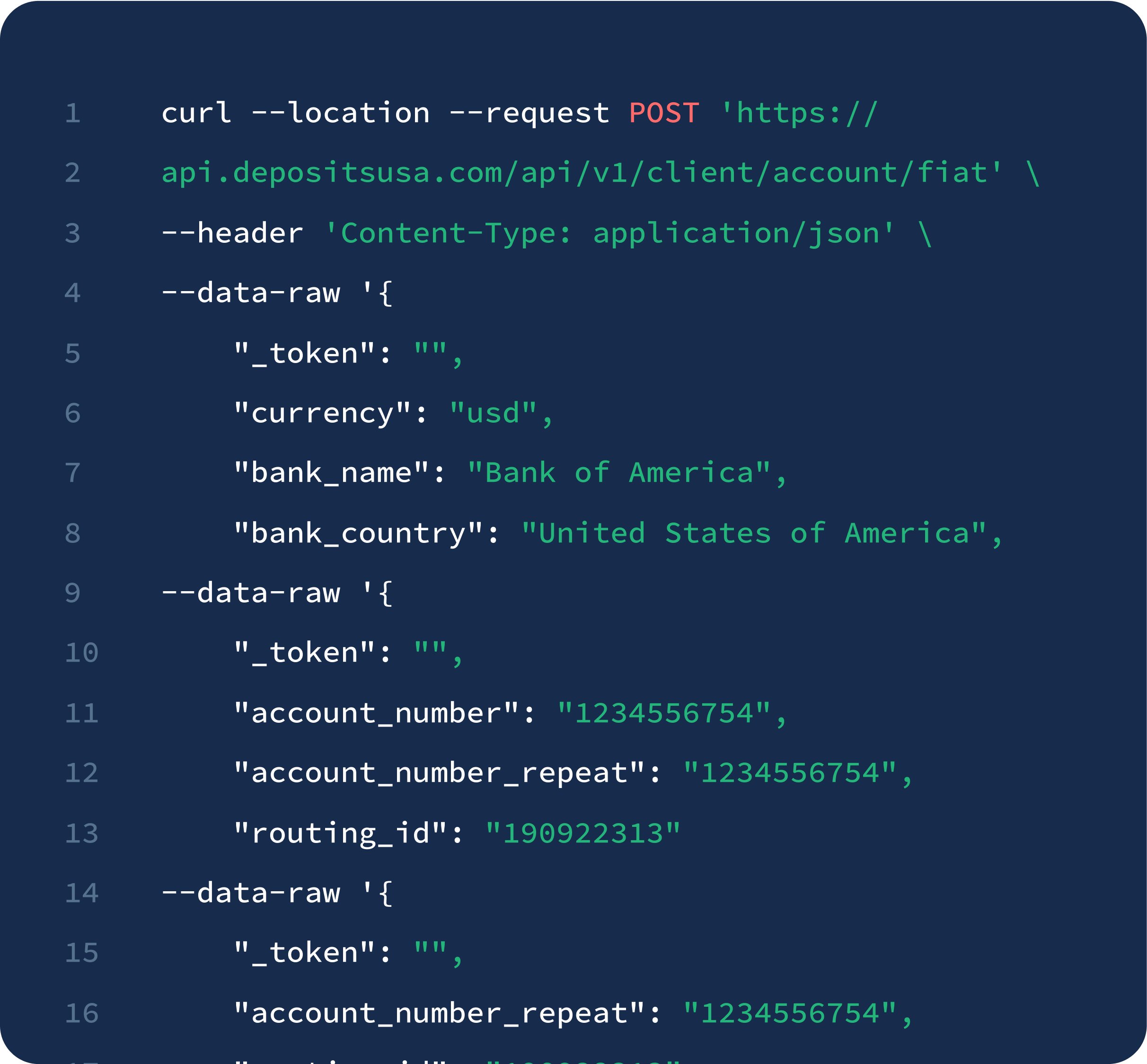

HOW IT WORKS

The platform money experience is built-on

Build and launch international remittance, multi-currency wallets, PFM app, or bill pay. The Money kit from Deposits is the toolkit to launch innovative fintech products.

use cases

What can you build with Money Kit?

With our Money Kit, we provide your financial world with a straightforward, quick, and easy solution.

Credit Building Program

Increase your credit score by making payments on a loan that is tailored to your needs.

Automatic Savings

Make the decision to save every time you spend, even just one cent. Choose an amount to lock down for each payment you receive to increase your savings.

Earned Wage Access

Do not let receiving your transfers take days. With our EWA feature, your funds arrives in your account the same day the transfer was done.

Have something else in mind?

Get in touch, and we’ll help you explore how you can build a custom financial product that’s right for your customers.

Talk to salesOur team is standing by and ready to help. Get live support from our team by phone, chat, or email, or reference the Help Center anytime.

Contact usFrequently asked questions

Money kit offers a templated, customizable "Digital bank -in-a-box" that enables companies to introduce consumer financial services in under 90 days.

Money is not a bank. However, banking services are provided by our partner banks or yours.

Money offers both virtual and physical debit cards.

Bring your bank partnership or launch with our partner bank.

Resources to keep you moving forward.

It’s your business. We just

want to help you keep doing it.

Can Community Banks Survive the Digital Age?

In the digital age, it is no surprise that people are preferring to use online banks over traditional community banks.

Read Now

Why and how community banks go digital

Community banks are described as those with $10 billion or less in assets. They provide banking services to local communities.

Read Now

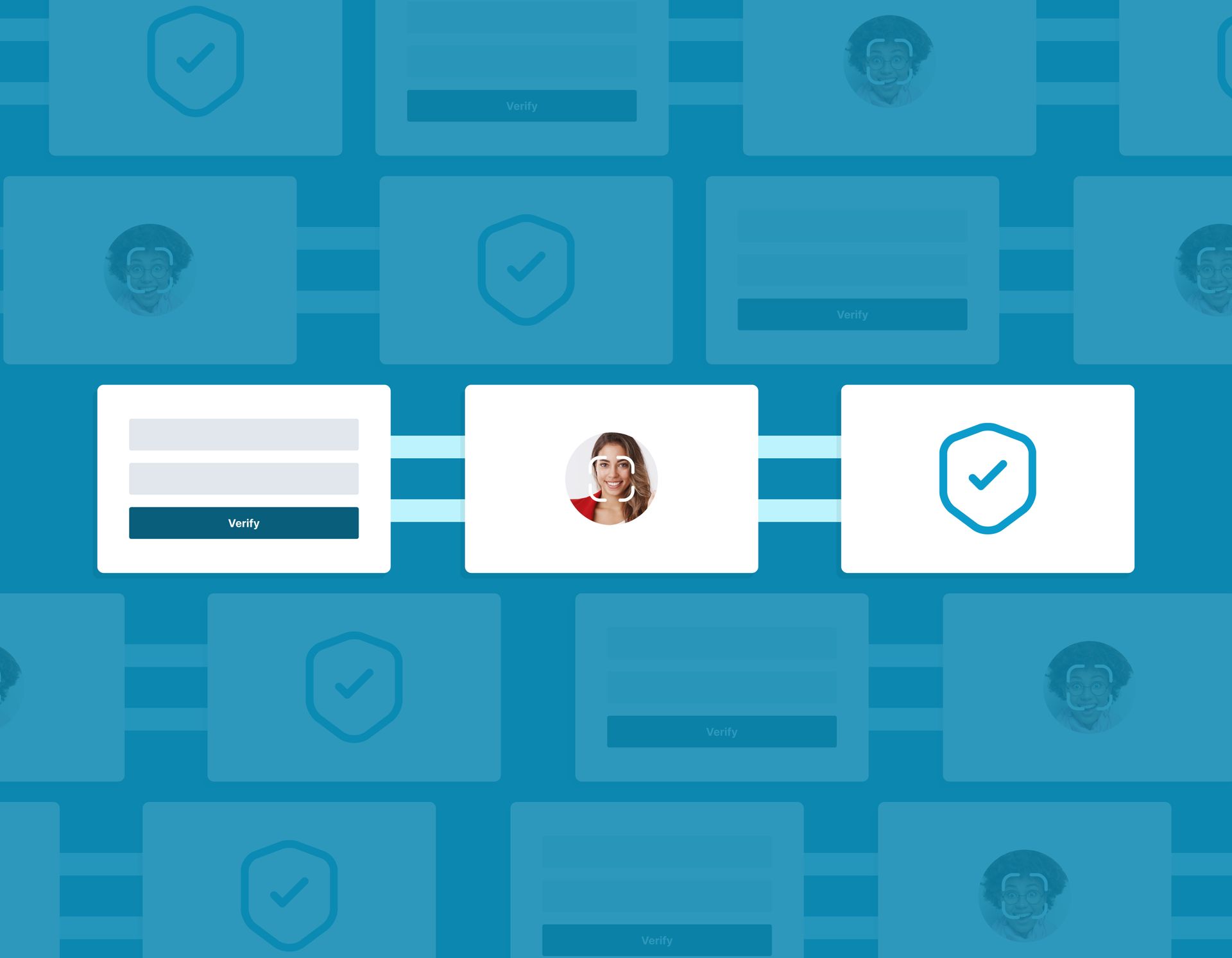

KYC with Kysync

KYC is becoming more strict across companies, especially financial institutions and it is driving a lot of their business decisions.

Read NowGet real support.

Talk to our Sales team

Find out which products fit your business needs and get questions answered.

Contact salesSupport Center

Access helpful tips, articles, and videos to get the most out of Deposits.

Visit our Support Center