identity kit

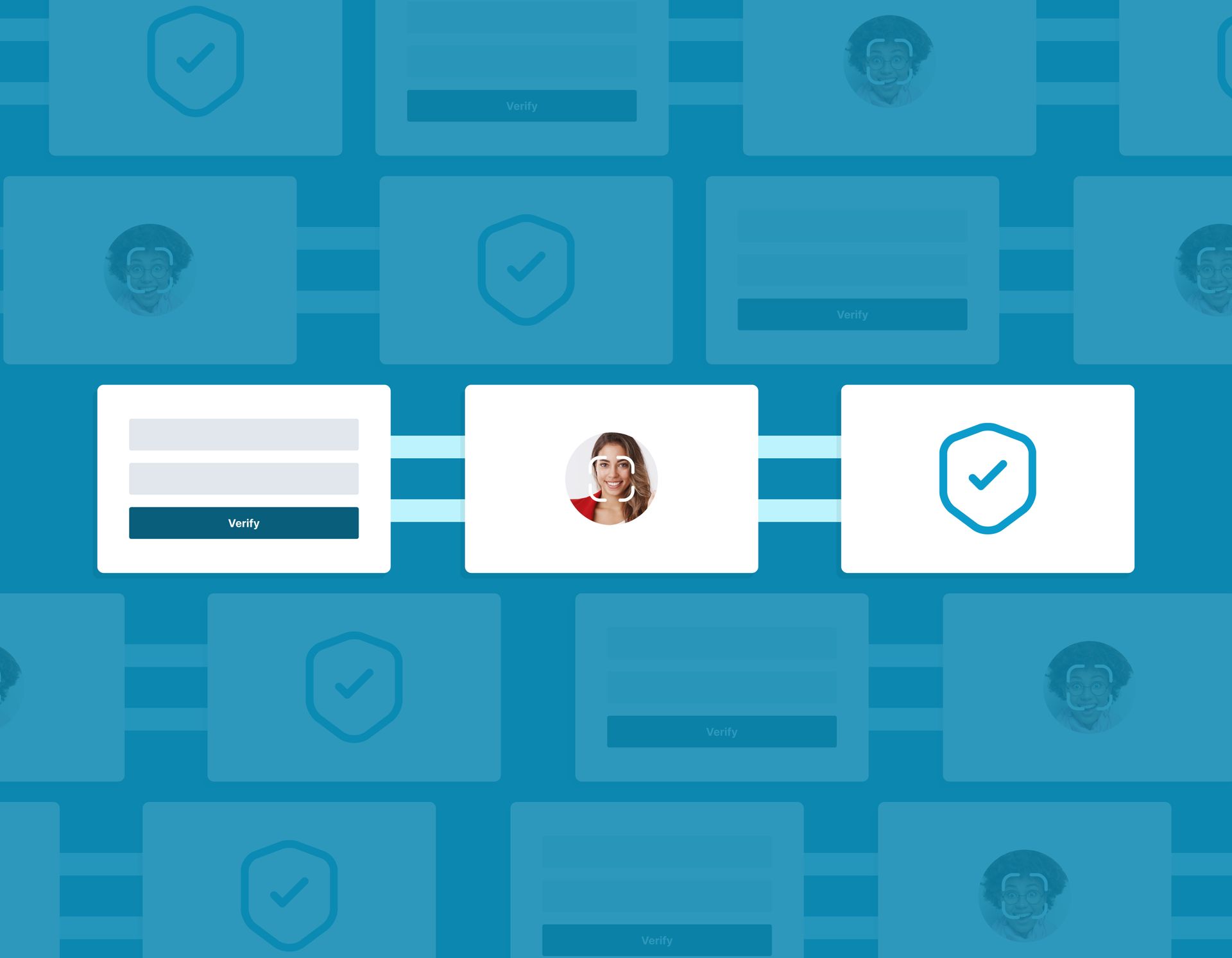

Zero to verification, instantly.

Identity Verification Document Verification Liveness Detection

A Single shot KYC, KYB and fraud prevention solution

It allows you to verify identities in one single API call, instantly. Verify an individual or business identity in seconds.

Email & Phone Fraud Prevention

Determine in real-time how risky a telephone or email is.

Document Verification

Verify and extract info from government issued documents in over 180 countries

HOW IT WORKS

Identity Kit as a service

Our identity kit allows you to start in seconds. Plug & Play solution with an embedded backoffice. Bulk upload your entities and automate your identification process.

Start Building Documentation

use cases

What can you build with Identity Kit?

Quickly launch a secure and feature-rich KYC or KYB service. Get the right entities verified and onboarded to your financial service instantly.

Identity Verification

Verify users faster and more efficiently than ever before.

Continuous Compliance

Maintain compliance by verifying your users every step or tier of the way.

Full-Suite Verification

Integrate document, facial recognition, email, and other verification services in your products.

Have something else in mind?

Get in touch, and we’ll help you explore how you can build a custom financial product that’s right for your customers.

Talk to salesOur team is standing by and ready to help. Get live support from our team by phone, chat, or email, or reference the Help Center anytime.

Contact usFrequently asked questions

KYSync is a single-shot KYC, KYB, and fraud prevention solution by deposits. It allows you to verify identities in one single API call instantly.

KySync can be customized according to your requirements. We can do KYC & KYB for your entities. You can also choose what features you want to turn on or off in the settings tab. KySync supports email, phone, document, liveness detection, and verification of a particular entity. For KYB, we also carry out verification of business addresses as well as partners. The unique URL is sent to your entity, and the response is recorded in the back office. Your entities can do Kysync while you sleep at their convenience. You can also send multiple kysync requests to update your data. You can go ahead and manually verify an entity as well. The options are endless. We also have customized pricing according to your business use case.

It is up to you. Completely flexible, you can request a new kysync the next day if unsatisfied. The Kysync is at the discretion of the user. However, your entities' data are updated in real-time, where we cross-verify them through accurate data sources APIs of our partner.

Yes, we do have a sandbox that you can experiment with. Please go ahead to sandbox.launch.new, create your app, and we will give you sandbox access to test out the back office and KYsync. You can also view our demo videos.

KYsync stores all collected PII with banking grade AES-256 bit encryption and stores that encrypted data in PCI-compliant servers.

Resources to keep you moving forward.

It’s your business. We just

want to help you keep doing it.

Can Community Banks Survive the Digital Age?

In the digital age, it is no surprise that people are preferring to use online banks over traditional community banks.

Read Now

Why and how community banks go digital

Community banks are described as those with $10 billion or less in assets. They provide banking services to local communities.

Read Now

KYC with Kysync

KYC is becoming more strict across companies, especially financial institutions and it is driving a lot of their business decisions.

Read NowGet real support.

Talk to our Sales team

Find out which products fit your business needs and get questions answered.

Contact salesSupport Center

Access helpful tips, articles, and videos to get the most out of Deposits.

Visit our Support Center